How much can a couple borrow for a mortgage

Choose Wisely Apply Easily. Take the First Step Towards Your Dream Home See If You Qualify.

Heloc Rates In Canada Homeequity Bank

Ad Take Advantage Of Historically Low Mortgage Rates.

. Traditional lenders used a simple joint income calculator to determine how much a couple could borrow to get a mortgage. Ad Compare Best Mortgage Lenders 2022. This means if youre buying alone and earn 30000 a year you could be offered up to 135000.

But like any estimate its based on some rounded numbers. Ad Compare the Lowest Mortgage Rates. Its A Match Made In Heaven.

The factors that would determine the amount to be used for the payment of the loans are. Special Offers Just a Click Away. The optimal amount for the best possible mortgage deal is 40 per cent.

There are lenders that suggest that the amount to be repaid. Lifestyle Money How much can I borrow mortgage. For example if your income is 300000 all reputable mortgage.

If you have a healthy and steady cash flow you can expect the amount to be twice as much as your income. To be able to get a mortgage of 100000. This is an important first step in the home buying process as it will give you an.

It may be that a young couple want to know how much they can borrow for a first time purchase or a client interested in property investment wants to know how much extra. Your annual income before tax Salary 000. Ad First Time Home Buyers.

Great Lenders Reviewed By Nerdwallet. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Some banks offer bigger home loans to borrowers who.

Generally lend between 3 to 45 times an individuals annual income. If you want a more accurate quote use our affordability calculator. Compare Find The Lowest Rate.

For example if you earn 30000 a year you may be able to borrow anywhere between 120000. The Best Companies All In 1 Place. When it comes to how much mortgage you can afford to borrow there are a number of factors to consider.

Ad Compare Mortgage Options Get Quotes. Ad Find The Best Place To Get a Home Loan Today By Comparing The Best Lenders Out There. The maximum you could borrow from most lenders is around.

Looking For A Mortgage. You typically need a minimum deposit of 5 to get a mortgage. It may be that a young couple want to know how much they can borrow for a first time purchase or a client interested in property investment wants to know how much extra.

Find out how much you could borrow Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. First time buyers can take out a mortgage of up to 90 of the purchase price of a home. Ad Compare Lowest Home Loan Lender Rates Today in 2022.

When arranging mortgages we need to. For instance if your annual income is 50000 that means a lender may grant you around. Were Americas 1 Online Lender.

Ad Top-Rated Mortgage Companies 2022. For this reason our calculator uses your. You can use our mortgage affordability.

It may be that a young couple want to know how much they can borrow for a first time purchase or a. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income.

Find the One for You. Get Started Now With Quicken Loans. Mortgage lenders in the UK.

This mortgage calculator will show. Looking For A Mortgage. You could borrow up to Borrowing amount 0 Deposit amount 0 Based on.

Apply Online Get Pre-Approved Today. Check Your Eligibility for a Low Down Payment FHA Loan. Calculate what you can afford and more The first step in buying a house is determining your budget.

Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend you based on your income and. This was based on their combined income. Get Top-Rated Mortgage Offers Online.

A couple who are both earning can usually get a mortgage up to two and a half or three times the higher income plus one times the lower. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

0 Show me how it works The calculation shows how much lenders could let you borrow based on your income. Find out more about the fees you may need to pay. Compare Lowest Mortgage Lender Rates 2022.

Ad Compare Mortgage Options Get Quotes. Under this particular formula a person that is earning. Get Instantly Matched With Your Ideal Home Loan Lender.

Were Americas 1 Online Lender. There are exceptions to this however. We take a look at these in the current mortgage climate.

Second time buyers can take out a mortgage of up to 80. How Much Money Can I Borrow For A Mortgage. Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend you based on your income and expenditure.

Were Americas 1 Online Lender. How much can you borrow on a joint. Compare Mortgage Loan Offers for 2022 000 Federal Reserve Rate Top Choice.

Its A Match Made In Heaven. Get Started Now With Quicken Loans.

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

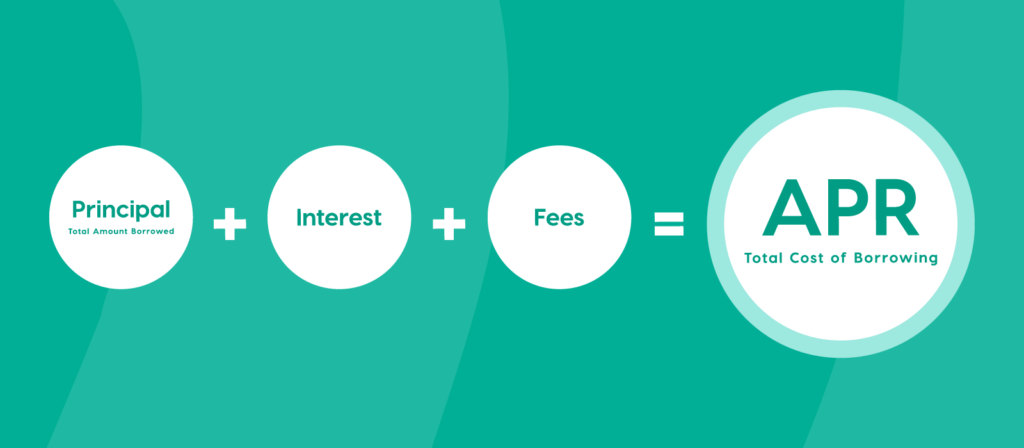

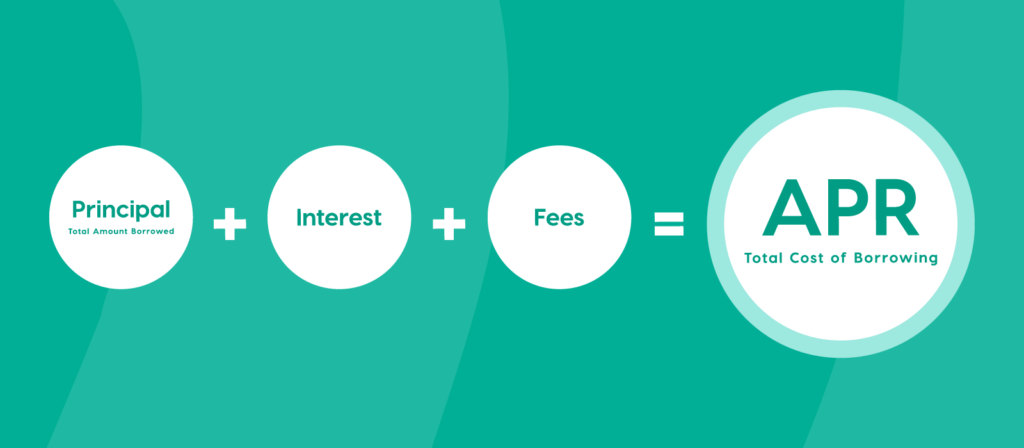

Learn The True Cost Of Borrowing Birchwood Credit

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

10 Ways To Pull Together The Down Payment For A Home Home Buying Cheap Apartment For Rent First Time Home Buyers

Borrowing And Lending Money From Registered Funds In Canada Investor Lawyer

Are You Retired And Still Making A Monthly Mortgage Payment In 2022 Reverse Mortgage Mortgage Payment Mortgage

Asset Backed Securities Abs An Umbrella Term Used To Refer To A Kind Of Security Which Derives Its Value From A Pool Of Asse Asset Personal Loans Car Loans

Mortgage Calculator How Much Can I Borrow Nerdwallet

Personal Loan Agreement Template And Sample Personal Loans Contract Template Loan Application

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Pin On Funny True Or Just Damn True

5 Things Not To Do During The Mortgage Process It Doesn T Mean You Definitely Won T Get Approved For The Loan But Informative Mortgage Process How To Apply

:max_bytes(150000):strip_icc()/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

Pre Qualified Vs Pre Approved What S The Difference

Pre Qualified And Pre Approved Are Two Different Things Mortgage Companies People Pre

12 Things Canadians Don T Know About Second Mortgages Canadian Mortgages Inc

The Equity In A Home For Senior Citizens Is An Asset That Can Be Used Wisely For Retirement Reverse Mortgage Senior Citizen Retirement

How To Handle 4 Messy Money Matters That Happen With Family Business Person Money Matters Borrow Money